December 3, 2025 — CommasMax, a leading intelligent quantitative trading platform, has officially launched its Global Integrated Risk Control Network—a major system upgrade designed to strengthen real-time risk monitoring, expand fund transparency, and create a more secure trading ecosystem for users across international markets.

This new release represents one of the most significant technological leaps in the company’s recent development history. As global traders increasingly demand safer automated systems and clearer visibility into strategy behavior, CommasMax’s latest innovation aims to deliver a more predictable and trustworthy trading environment.

A More Robust Non-Custodial Framework for Modern Traders

Founded in the United States in 2019, CommasMax has long distinguished itself with a strict non-custodial approach, allowing users to maintain complete control over their exchange API permissions. Traders can modify or revoke access instantly, ensuring full ownership of their assets at all times.

With the introduction of the Global Integrated Risk Control Network, the platform enhances its core philosophy of Non-Custody + Shared Risk. This upgrade brings improved transparency to strategy execution processes, fund routing logic, and risk detection workflows—significantly reducing the types of centralized vulnerabilities seen in custodial platforms.

Global Multi-Node Monitoring With Institutional-Level Precision

The new system incorporates a network of global monitoring nodes, a real-time strategy traceability engine, and a comprehensive anomaly detection pipeline that spans key markets across the Americas, Europe, and Asia-Pacific.

Powered by millisecond-level market analytics and years of multi-cycle data, the platform now delivers institutional-grade risk protection—without requiring users to hand over control of their funds.

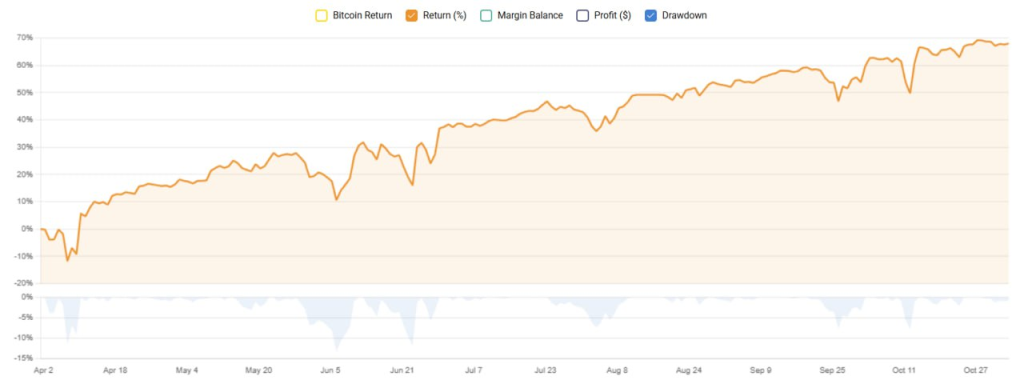

Backed by Strong Live Performance Across Market Cycles

CommasMax’s strategy models have built an extensive track record through bull markets, bear phases, and periods of extreme volatility. This long-term performance data has been deeply integrated into the underlying architecture of the Global Integrated Risk Control Network.

The system now identifies not only traditional price-driven risks but also deviations in strategy logic—strengthening its dual-layer protection model designed to mitigate severe drawdowns and protect user capital.

Empowering Users Through Complete Asset Autonomy

Industry analysts note that combining a non-custodial system with a global risk management network significantly increases user independence and operational confidence. Users maintain direct control of their assets on major exchanges, granting CommasMax permission solely to execute trades—not to withdraw or access funds.

Traders can pause strategies, revoke authorization, or step in manually at any time. CommasMax’s role remains fully limited to strategy execution and monitoring, ensuring transparent and well-defined responsibilities.

Looking Ahead: More Transparency, More Intelligence

CommasMax plans to expand its risk management infrastructure by:

- adding more global monitoring nodes

- improving strategy behavioral analysis

- enhancing abnormal trading detection

- strengthening cross-exchange liquidity oversight

- deepening permission-level security monitoring

The company is also preparing to introduce visualized risk dashboards, giving users access to real-time insights into strategy conditions, exposure levels, and risk interception activity—bringing full transparency to every stage of the trading lifecycle.

About CommasMax

Established in 2019, CommasMax is an intelligent quantitative trading platform offering advanced automated strategies within a fully secure non-custodial environment. Its mission is to make institutional-grade trading technology accessible to users worldwide.

CoinsMax Trade Tech Ltd

Denver, United States